- #CREATE 1099 IN QUICKBOOKS ACCOUNTANT ONLINE HOW TO#

- #CREATE 1099 IN QUICKBOOKS ACCOUNTANT ONLINE SOFTWARE#

Before you start the 1099 process, make sure you have all the correct information on your contractors and vendors. QuickBooks is easy to use which ironically can be the reason why people, if not properly trained on how to use it, can run into problems with improper set-up, postings, and more.

Choose the boxes to categorize your contractors payments, and click Next.On the Review your company info page, click Next.

#CREATE 1099 IN QUICKBOOKS ACCOUNTANT ONLINE SOFTWARE#

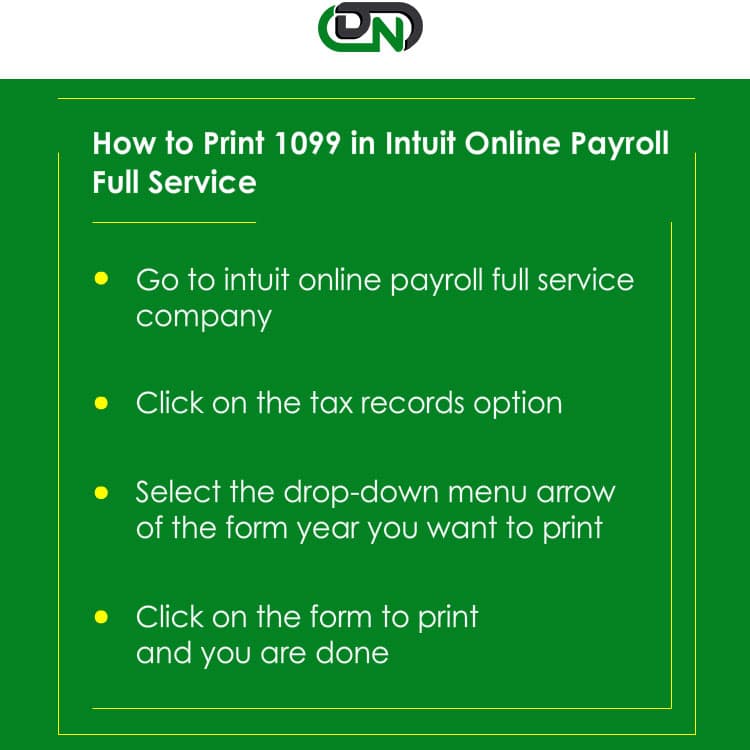

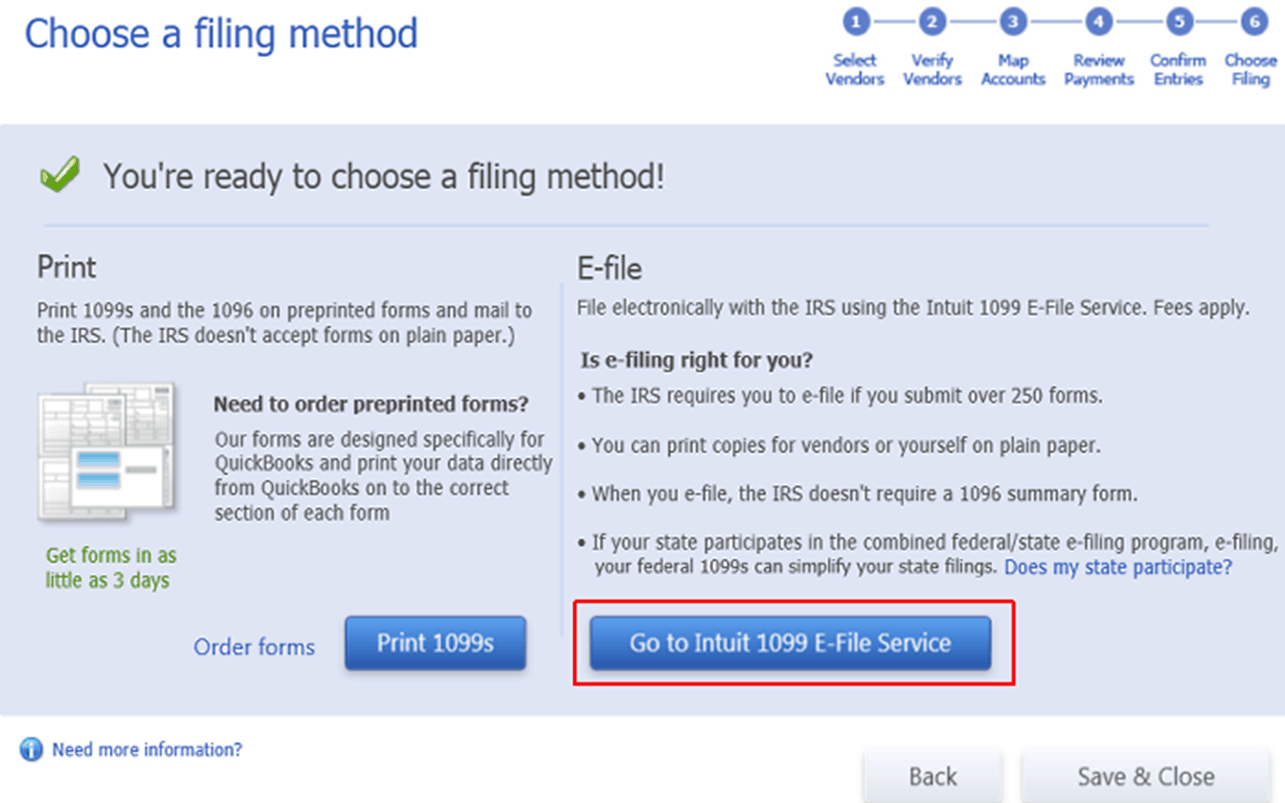

Click the Prepare 1099s drop-down menu. Three of the best 1099 software packages for accountants are W2 Mate by, Intuit TurboTax Business, and Wolters Kluwer W2 / 1099 by CCH.On top of that, employees receive more benefits, such as healthcare and 401k matching, and have better job security. Learn how to get access to these tools in QB Desktop & Online. On the left panel click Expenses, and select Vendors. W-2.In the past, it was usually a better tax choice to be a W-2 employee than to be self-employed, because employees paid slightly lower taxes on equivalent pay. QuickBooks Desktop Enterprise enables the use of accountant tools for all Enterprise clients.Here's how you can print the 1099 summary: The 10 Wizard will be displayed and will step you through the process of generating the 1099 forms. To print the 1099-MISC forms, from the Vendor menu, select Print 1099s/1096. Click View past forms.Īlso know, how do I print a 1099 list in QuickBooks? If 1099-MISC forms are required to be sent to vendors for more than just labor or services in the future, additional accounts will be added in this section. Creating a 1099 form for a contractor whom you've added to the employee list is more time-consuming than for a vendor, but completing the procedure ensures the contractor has the correct tax status. Click the Company Preference tab.Īdditionally, where do I find 1099 in QuickBooks online? If you've e-filed the 1099 forms in QBO, you can access them between January 1 through April 30 at any time by logging into your 1099 E-File Service account. QuickBooks business accounting software enables you to generate 1099 forms for both categories of independent contractor. Take advantage of these five features to help keep your clients in the know and accomplish your tasks from organizing all of your clients’ contact information to taking notes to sharing important documents. To activate the 1099 feature: Choose Edit > Preferences. With QuickBooks Online Accountant, communicating with your clients is simpler and more secure than ever. Similarly one may ask, how do I enable 1099 in QuickBooks? Select "Vendors and Payables" from the drop-down menu. Click the "Reports" tab at the top of your QuickBooks screen.

0 kommentar(er)

0 kommentar(er)